Stock Analysis

|

The idea of the project is to code a stock analysis program that can analyze stocks for those who don't have time. Using ThinkorSwim, and ThinkScript, the program will implement metrics and algorithms to aid the user in purchasing stocks.

|

Meet the Program

|

Filter Portion:

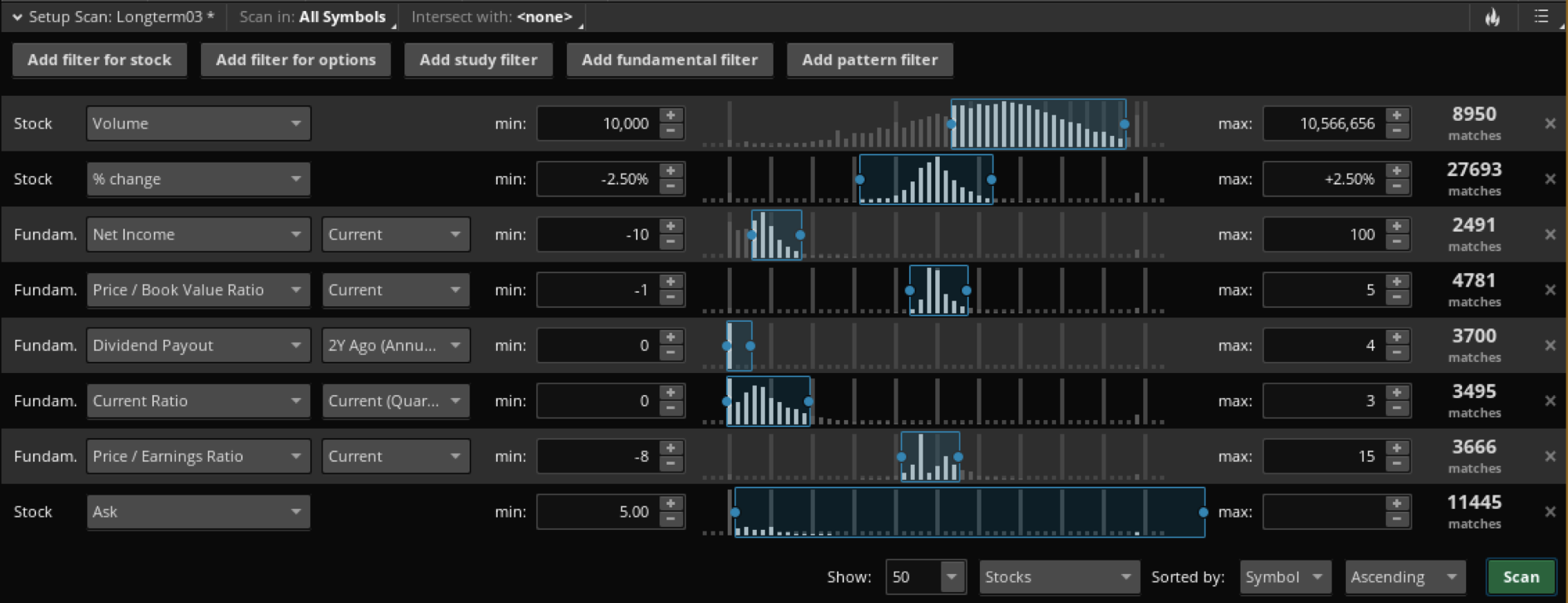

The filter portion of the project uses a number of variables including price, volatility, growth rate, and earnings to determine which stocks would be good candidates for the evaluation portion. |

Evaluation Portion:

The coding portion applies an algorithm I wrote, that looks at the price and several moving averages, to determine if the stock is worth buying and if I estimate the stock to grow. |

The filter portion of the program uses quantitative fundamental data to scan and select stocks, and then I can later apply algorithms to them.

The equation provides several variables which are graphed on the chart. The variables are used to visually assist in determining the viability of a stock.

These are a number of the stocks I am currently holding. The result is approximately 14% growth, however the growth is actually greater. Because the stocks do not sell, many of them have grown significantly then fallen slowly. If sold at the right time, the returns would be at least 14% (current value holding all stocks purchased) and up to 40% over the past 7 months. Even if the full 40% isn't reached, a decent return percentage in the 20s would be quite attainable if I decided to sell stocks as well.